NMDC Energy listed on FADXI15 Index for Islamic Finance Compliance

- NMDC Energy has joined a group of 15 listed entities, known as the FADXI15, forming a Shariah compliant index for global Islamic investors.

- The company was recently listed on the Abu Dhabi Securities Exchange (ADX) following an Initial Public Offering (IPO) which was oversubscribed by 31.3 times.

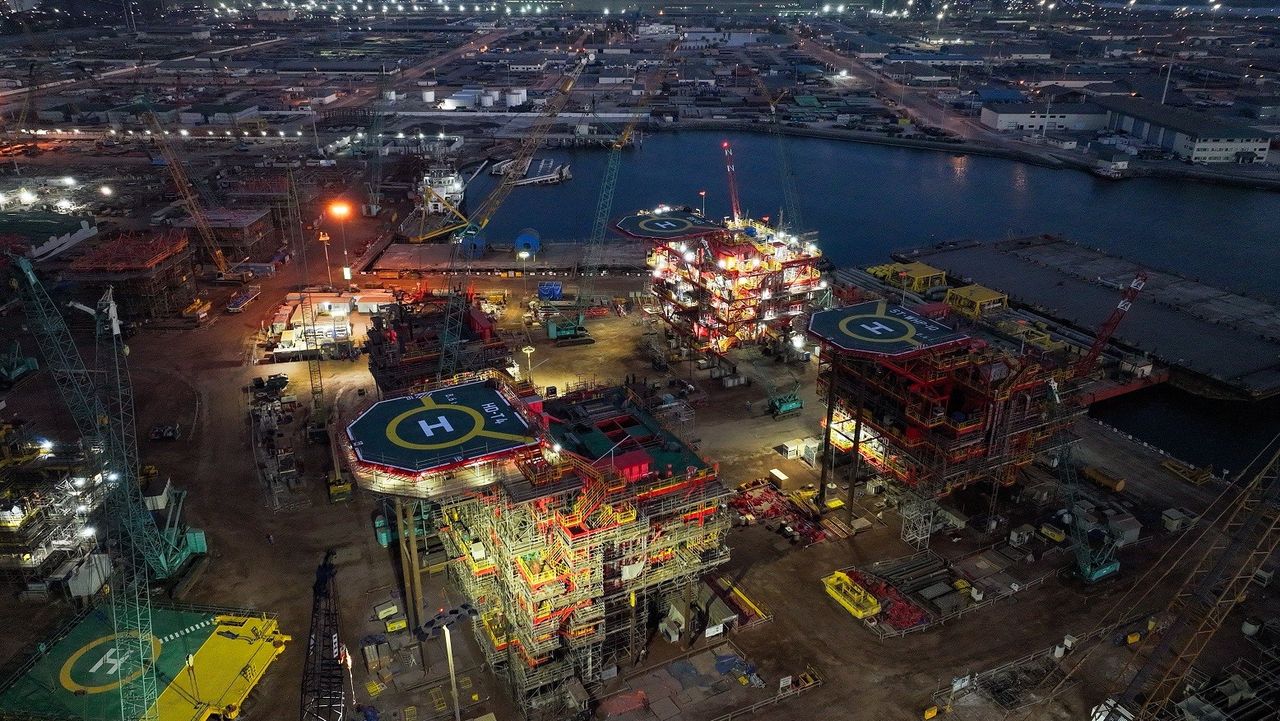

Abu Dhabi, UAE: 29 October 2024 – NMDC Energy PJSC (ADX: NMDCENR), a provider of engineering, procurement and construction services for offshore and onshore energy clients, and a majority-owned subsidiary of NMDC Group PJSC (ADX: NMDC), has been recognized as one of the largest listed Islamic complaint entities in Abu Dhabi.

NMDC Energy has joined a group of 15 listed entities, known as the FADXI 15, forming a Shariah compliant index for global Islamic investors. This new index was launched by FTSE Russell, an LSEG business, and Abu Dhabi Securities Exchange (ADX) to augment ADX’s leading role in the GCC region and establish the next-generation benchmarks for this dynamic and expanding market.

Eng. Ahmed Salem Al Dhaheri, CEO of NMDC Energy, said: “NMDC Energy’s historic listing this year has been a profoundly significant development for the region’s growing and dynamic energy industry. On the back of our successful IPO, we also went on to achieve record profits, delivering a 145% year-on-year increase in net profit for the three months ending 30 September 2024. We’re proud to announce another significant milestone for the company, as it joins a unique grouping of Abu Dhabi entities, who together are helping to facilitate the growth of Islamic finance as well as improve its accessibility to a wider investor base.”

NMDC Energy’s net profit for the three months ending 30 September 2024 rose from AED 164 million to AED 402 million, driven by strong operational performance and strategic expansion into new projects. Revenues soared to AED 3.975 billion, up 110% from the corresponding period of 2023.

The company achieved record growth rates in net profits in the nine-month period ending 30 September 2024, reporting a net profit of AED 904 million, reflecting a 122% increase compared to the same period of 2023. The revenue for the first nine months of 2024 stands at an all-time record high AED 9.78 billion, up 96% from the corresponding period in 2023.

ADX has a market capitalization of Sharia-compliant financial instruments listed on ADX, which exceeds AED 2 trillion (USD 549 billion). It aims to advance its capital market by continuously introducing innovative Sharia-compliant products, meet the diverse investor needs and expand its range of financial products to provide greater choice and opportunity.

Go Back